Table of Contents

March 2023 Recent trends in funding for AI companies

Published 29 March, 2023; Last major updated 3 April, 2023

13 July, 2023 update: Since the last major update for this page, several AI companies have received large investments, including \$1.3B for Inflection AI, \$500M for SandboxAQ, \$450M for Anthropic, \$350M for Adept AI, \$300M for OpenAI, \$270M for Cohere, and \$150M for character.ai.

For broader, but less up to date analysis, see Funding of AI Research.

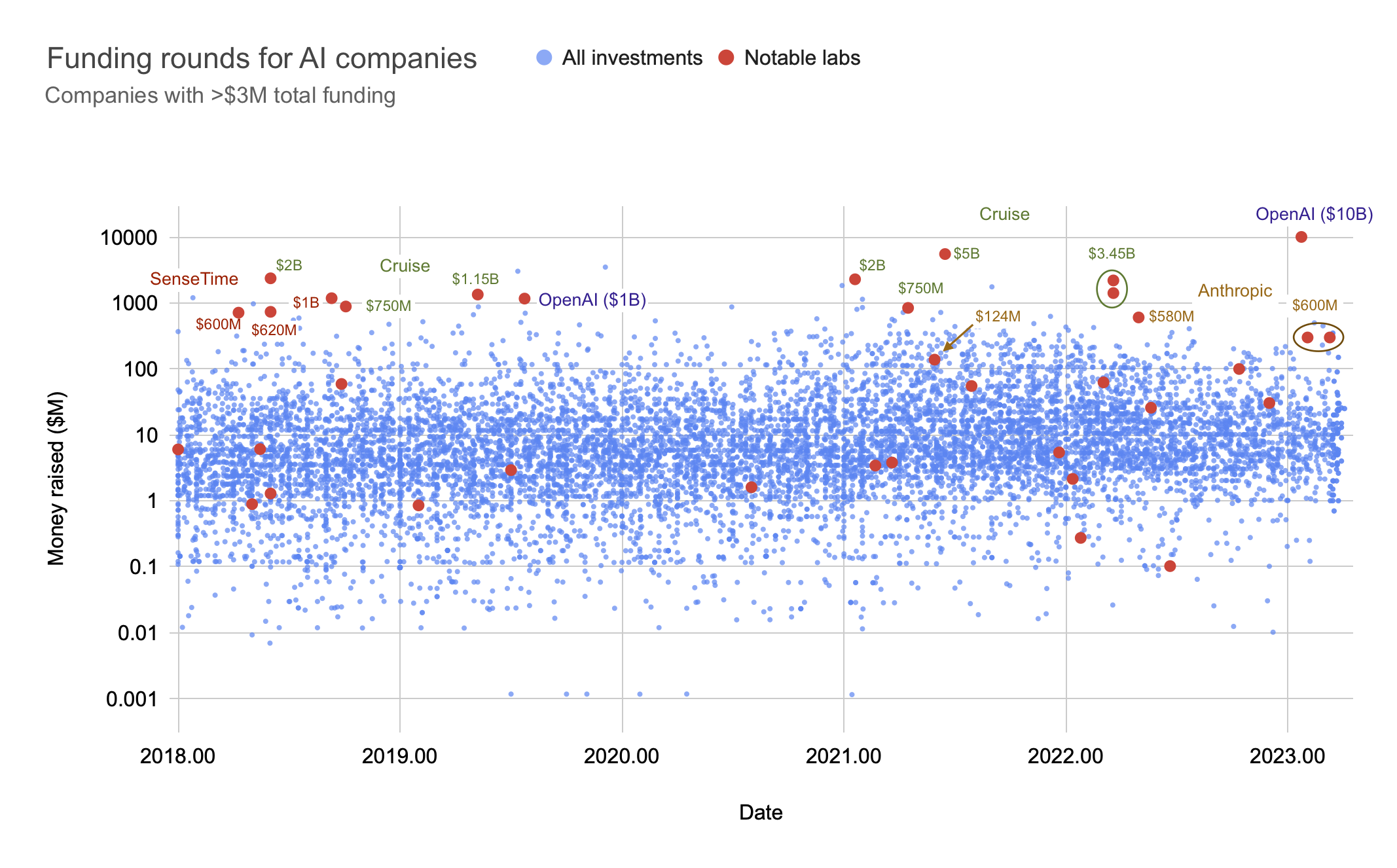

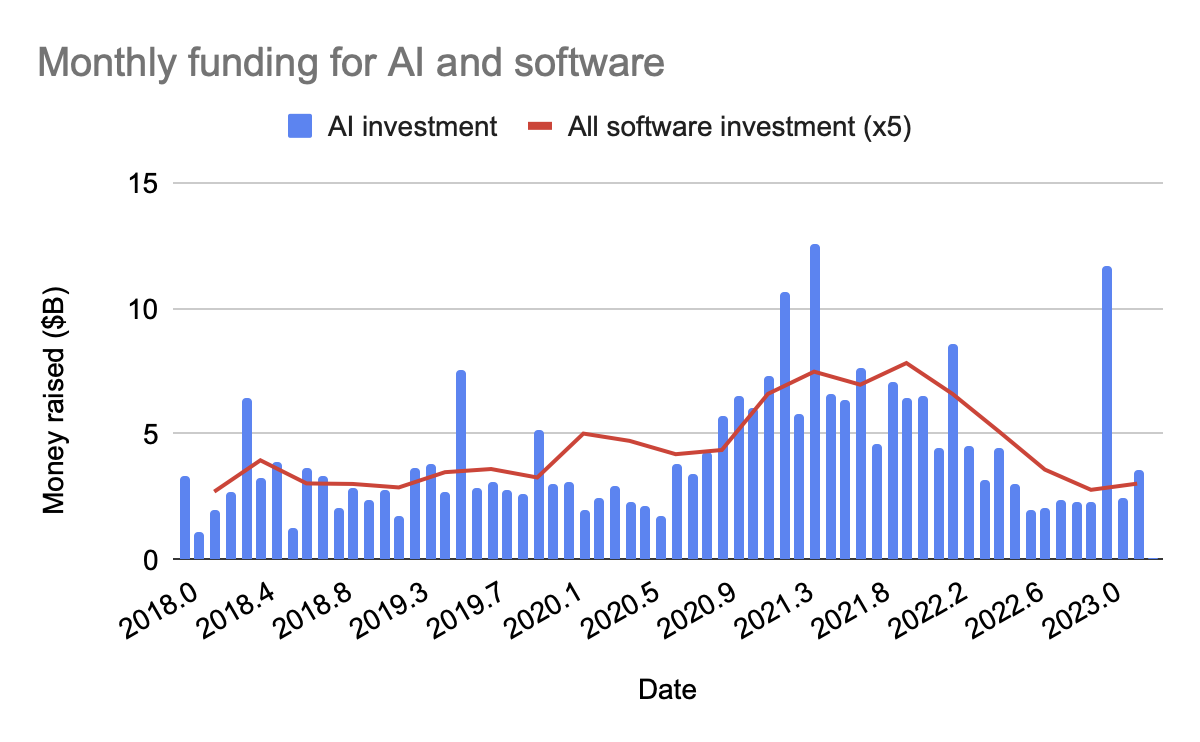

According to Crunchbase, funding for AI companies averaged \$36B/year from January 2018 through August 2020, rose sharply to average \$87B in 2021, then dropped to average \$37B from July 2022 to March 2023, during which time funding for OpenAI and Anthropic accounted for more than a third of all funding.

Details

We used Crunchbase to find investment data for private AI companies that received funding between January 2018 and March 2023, and received at least $3M of total funding over the lifetime of the company. We additionally identified major AI labs that received funding from January 2018 to March 2023.

Companies were identified based on their industry categorization on Crunchbase (either “Artificial Intelligence” or “Machine Learning”). We did not make a strong effort to discern how much these companies' efforts go toward AI-related activities, but our impression from examining a small sample is that, while most of the companies included make some claim to using AI, many are using relatively unsophisticated technology or do not use AI as part of their core business model.

All of the values in this article have been adjusted for inflation, unless otherwise indicated. This does not make a large difference–most of the aggregate statistics are changed by about 10% or less.1)

This data does not reflect the overall amount of investment in AI. For example, it does not include spending by companies with their own funding (e.g. Google spending on AI R&D), government contracts, or any private investment not captured by Crunchbase. While collecting data, we found several cases of missing data from Crunchbase. This suggests that our dataset may be incomplete, possibly in a misleading way. We have not tried to fill in or correct for missing data or systematically check for bias missing data.

Some of our data can be found in this spreadsheet.2) Our methods are explained in more detail in the Methods section.

Results

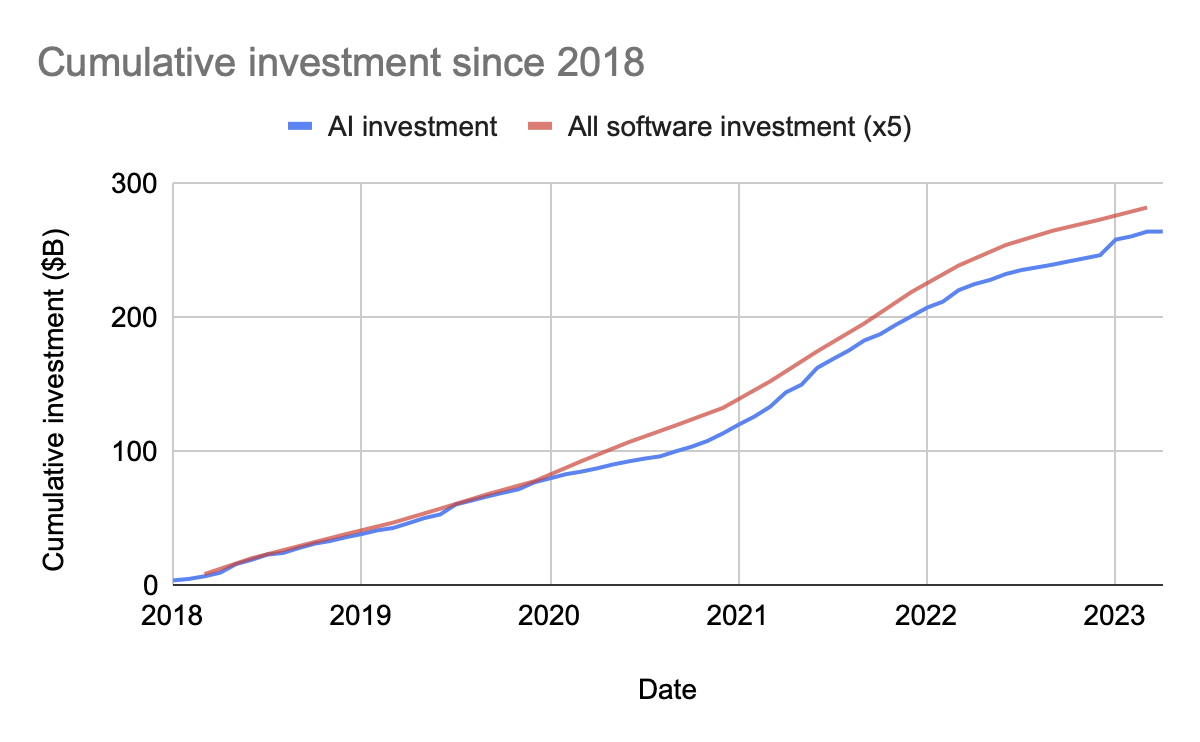

Between January 1, 2018 and March 28, 2023, approximately 9,000 AI companies raised \$267 billion. Of that funding, \$263B went to 4,483 companies across 9,958 funding rounds. This represents about 19% of funding for all software companies during that time, and 4.6% of funding for all companies from any industry during that time. Monthly funding for AI and software is shown in Figure 1, and cumulative funding is shown in Figure 2. The large spike in AI funding in January 2023 is a $10 billion investment in OpenAI by Microsoft, which was the largest ever investment in an AI company, and was tied for the third largest investment ever in any software company, according to Crunchbase.

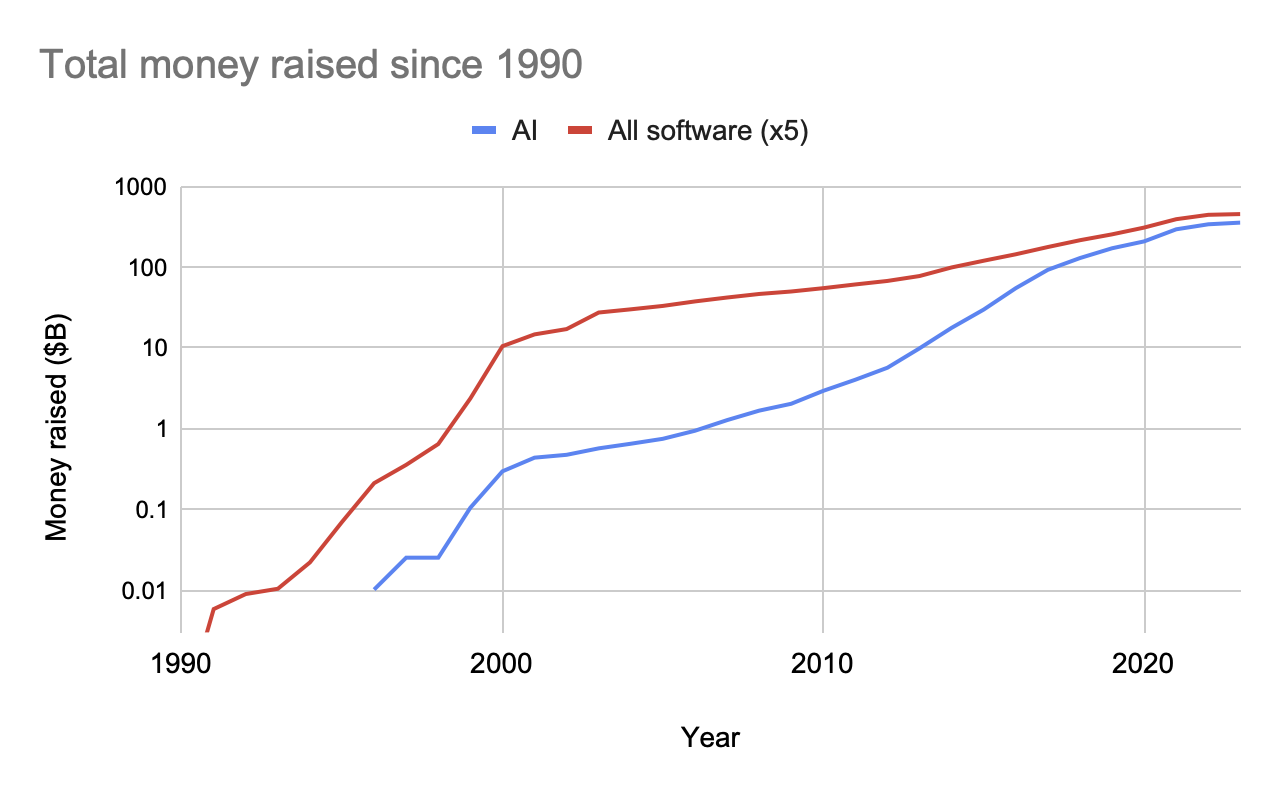

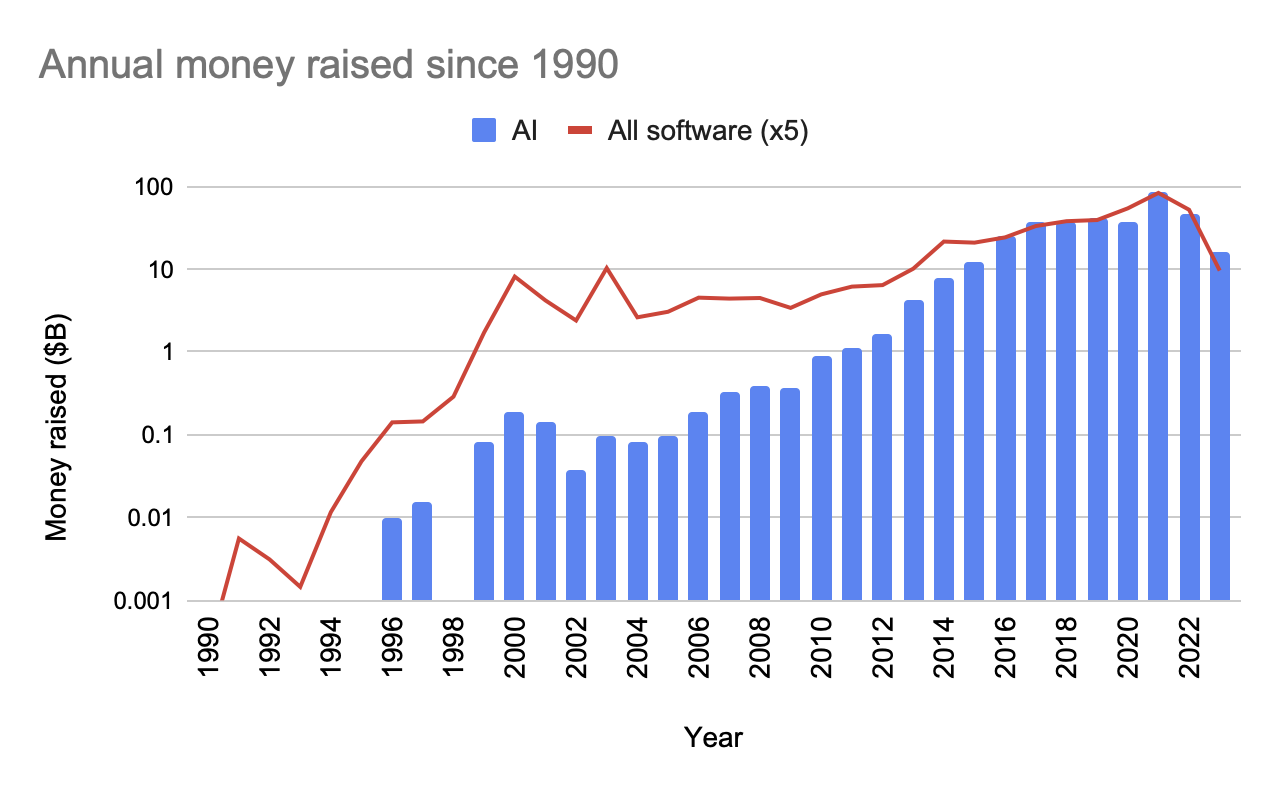

Funding for AI companies over the past five years has been a departure from the longer-term trend, which showed rapid, sustained growth, as shown in figures 3 and 4.

We identified 15 major or otherwise notable AI labs at private companies, based on major advances in AI research, the 2020 Survey of Artificial General Intelligence Projects for Ethics, Risk, and Policy, and our own judgement. Funding for these labs is shown, along with all other funding rounds in our database, in Figure 5.

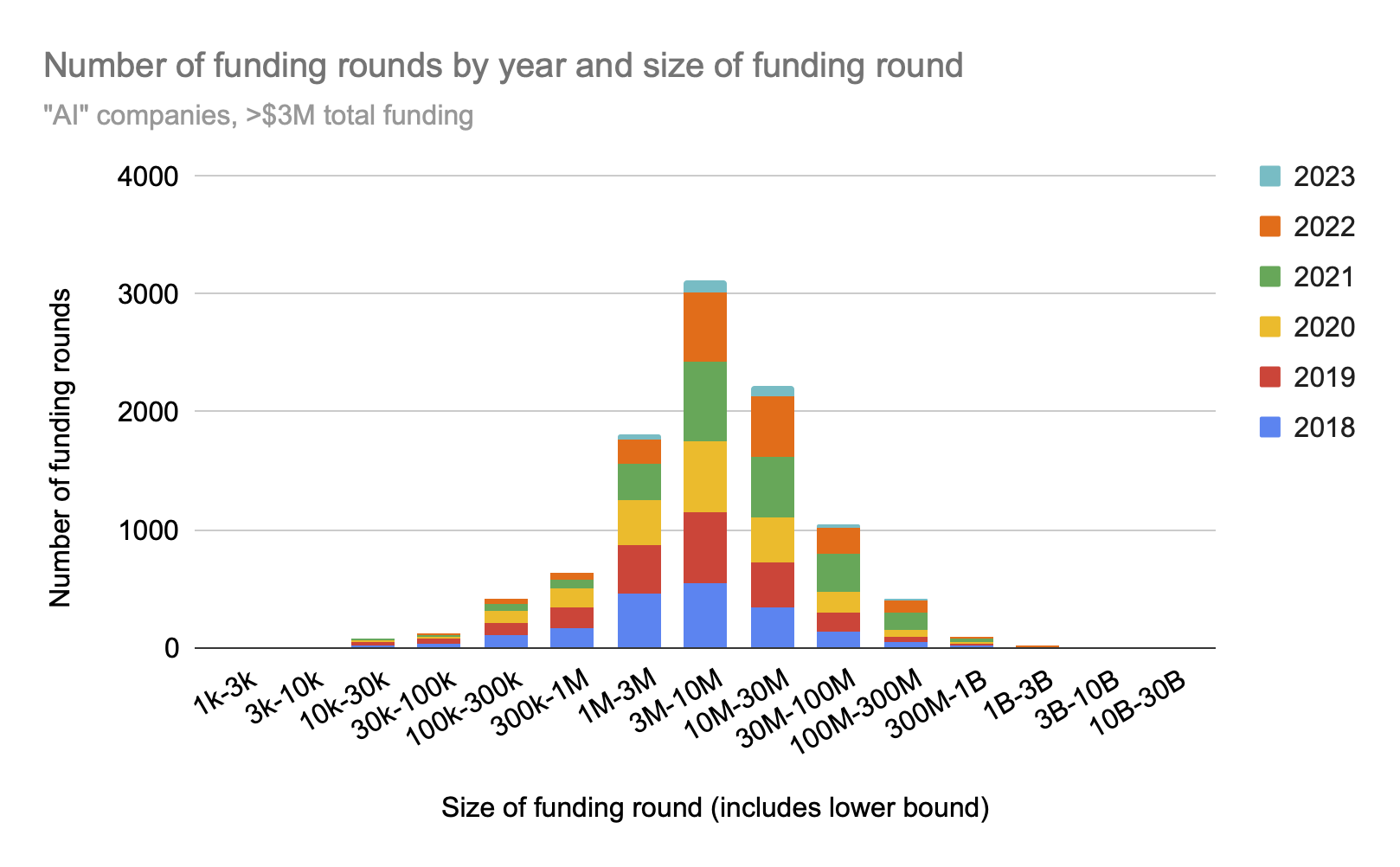

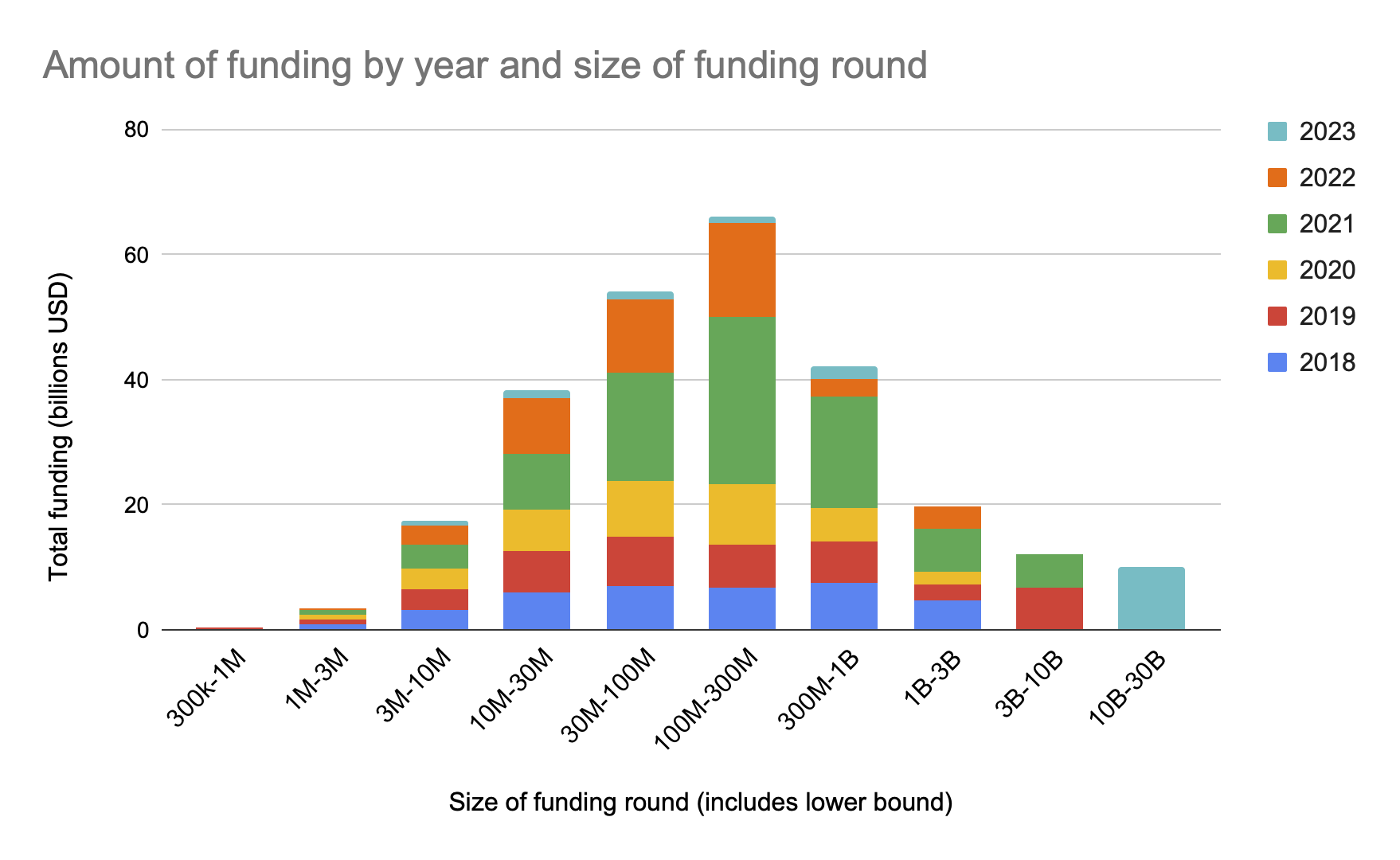

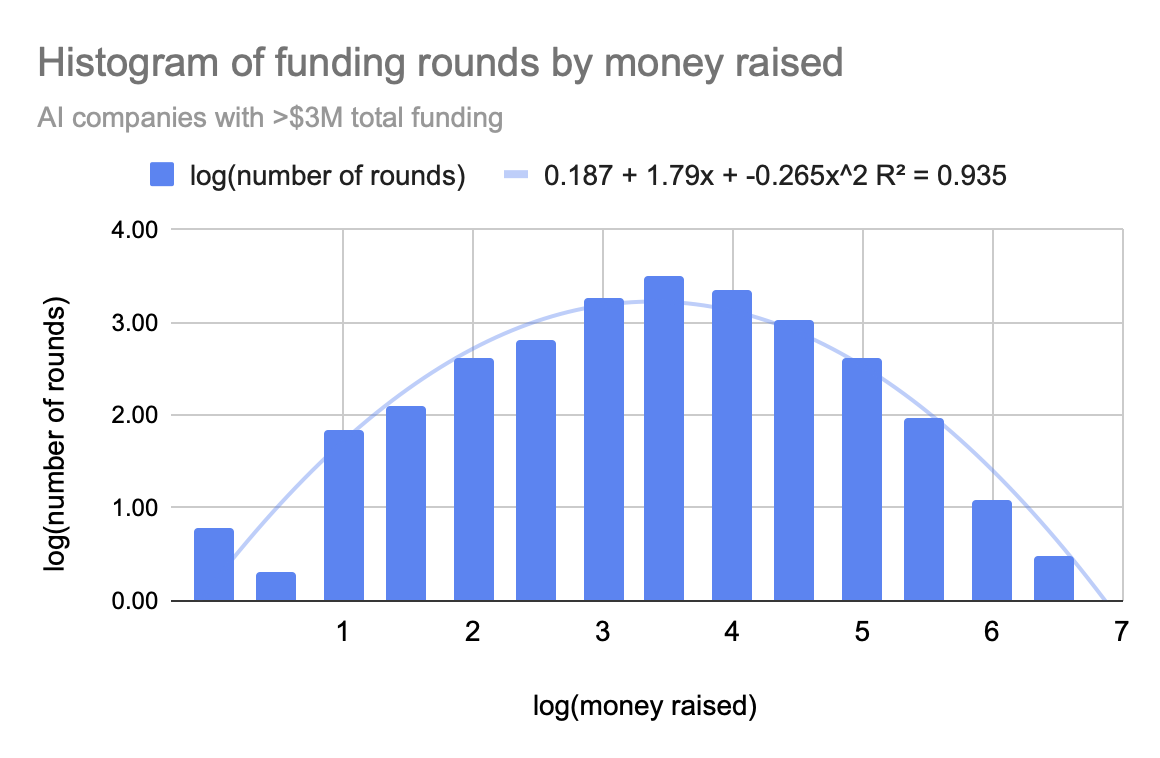

Funding rounds appear to be roughly log-normally distributed in money raised, though we did not perform any formal statistical tests to verify this. The number of funding rounds by size and year is shown in Figure 6, and the distribution of money across funding rounds of varying sizes is shown in Figure 7.

Methods

Search criteria

We searched Crunchbase for investment data on companies with “Artificial Intelligence” or “Machine Learning” listed as one of its industries, which had received funding since January 2018. Due to the difficulty of extracting large datasets from Crunchbase, we excluded companies with less than $3M of total funding, which reduced the size of the dataset by about 40%, while reducing the total funding included in the dataset by only 1.5%.

For long-term investments, we did not filter out companies with less than $3M of total funding.

List of notable labs

We created a list of major AI labs that received private investment since 2018. This was done the following way:

- For companies included in the 2020 Survey of Artificial General Intelligence Projects for Ethics, Risk, and Policy from GCRI3), we checked Crunchbase for recent funding rounds. Of the 72 projects included in the survey, 24 were associated with private companies and 11 of those had received funding since 2018. Three companies (Optimizing Mind, ORBAI, and FutureAI) had not been included in the original Crunchbase query, because they had not met the $3M cutoff.

- To identify influential AI labs, we searched the Methods page on Papers with Code for machine learning methods that had been used in at least 400 publications. If one of the authors for the publication introducing the method had a private company as an institutional affiliation, that company was added to a list. This resulted in 15 companies or organizations within companies, which was then filtered to exclude any that had not received private funding since 2018, leaving only one (SenseTime) that was not already included in our list of notable labs.

- Finally, we added companies that are known to us to be major players in AI development, or that commonly appear in lists of companies advancing the state of the art in AI. Only three such companies had recent funding data on Crunchbase, and had not already been included for other reasons (Cruise, Darktrace, and Stability AI).

The complete list of notable labs is in the Appendix.

Inflation correction

We obtained Consumer Price Index data from the Bureau of Labor Statistics4). The dataset we used was for all prices for all urban consumers, seasonally adjusted. The inflation data we used can be found in this spreadsheet under the tab “inflation_data”.

Random sample of AI companies

To evaluate the role that AI played in a typical company categorized as “Artificial Intelligence” or “Machine Learning”, we randomly sampled 10 companies that were included in the original dataset. Companies were evaluated informally, by reading the description on Crunchbase, visiting the company's website, and checking for information on how it uses AI or if it does original research on AI. The complete list of companies sampled is in the Appendix.

Appendix

List of notable AI labs

The following labs from the dataset were determined to be notable:

| Company | Total funding ($M) |

|---|---|

| SingularityNET | 66 |

| SenseTime | 2,650 |

| Akin | 5.6 |

| Graphen | 7.1 |

| Cruise | 15,000 |

| Intelligent Artifacts | 3.7 |

| Darktrace | 230 |

| ORBAI | 0.72 |

| OpenAI | 11,000 |

| Mindtrace | 4.7 |

| Anthropic | 1,300 |

| Brain Technologies | 51 |

| FutureAI | 2.0 |

| Optimizing Mind | 0.25 |

| Sanctuary Cognitive Systems Corporation | 90 |

| Stability AI | 99 |

List of randomly sampled companies

Additional figures

Plotting histogram of funding rounds by money raised on a log-log plot shows the data is fit reasonably well by a parabola, suggesting it is log-normally distributed.

Primary Author: Rick Korzekwa